Sukanya Samriddhi Yojana

Introduction

The Sukanya Samriddhi Yojana (SSY) is a flagship small savings scheme launched in 2015 under the Beti Bachao, Beti Padhao initiative by the Government of India. It is designed to encourage parents to build a secure financial future for their girl child, focusing on education and marriage. In 2025, SSY continues to be one of the most trusted investment options with high interest rates and tax benefits.

Eligibility

- Only for girl children below 10 years of age.

- Parents or legal guardians can open the account.

- Maximum two accounts per family (three in case of twins/triplets).

- The girl child must be an Indian citizen and resident.

Where to Open

You can open an SSY account at:

- India Post Offices

- Authorized banks like:

- SBI

- HDFC Bank

- PNB

- ICICI Bank

- Bank of Baroda

- Axis Bank, etc.

Required Documents

To open the account, you need:

- Girl’s Birth Certificate

- Parent/guardian ID proof (Aadhaar, PAN, etc.)

- Address proof

- Passport-size photos

- Duly filled SSY Application Form

Deposits

- Minimum deposit: ₹250/year

- Maximum deposit: ₹1.5 lakh/year

- Deposits can be made:

- Monthly or yearly

- Through cash, cheque, online transfer, NEFT, or auto-debit

- Deposits required for 15 years from the account opening year

Interest Rate in 2025

- 8.2% per annum (Q1 FY 2025–26, April–June)

- Compounded annually

- Announced by the Ministry of Finance every quarter

- One of the highest interest rates among government schemes

Duration & Maturity

- Account matures after 21 years

- Deposits only required for 15 years

- Account can be closed early:

- Upon marriage (after age 18)

- In case of death of account holder or girl child

- For medical emergencies (with proof)

Withdrawal Rules

Partial Withdrawal:

- Allowed after the girl turns 18

- Can withdraw up to 50% of the balance

- For higher education or marriage expenses

Full Withdrawal:

- Allowed after 21 years of account opening

- Allowed 1 month before or 3 months after marriage (girl must be 18+)

Premature Closure

Permitted in these cases:

- Death of account holder or girl child

- Medical emergencies

- Marriage of the girl (after 18 years)

- Change in citizenship/residency

Penalty-free if proper documentation is provided

Tax Benefits – EEE Status

SSY is fully tax-free under the EEE (Exempt-Exempt-Exempt) status:

- Investment up to ₹1.5 lakh/year under Section 80C – Tax Deductible

- Interest earned – Tax-Free

- Maturity proceeds – Tax-Free

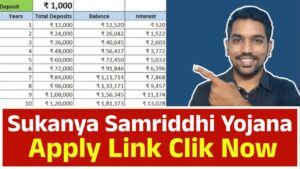

Sample Calculation

If you deposit ₹1.5 lakh every year for 15 years:

- Total Investment: ₹22.5 lakh

- Approximate maturity value at 8.2%: ₹65–₹75 lakh

- This helps secure a girl’s college education or marriage

Comparison with Other Schemes

| Scheme | Interest Rate | Tenure | Tax Status | For |

|---|---|---|---|---|

| SSY | 8.2% | 21 years | EEE | Girl Child |

| PPF | 7.1% | 15 years | EEE | Anyone |

| RD | 6.5–7% | 5–10 years | Taxable | General |

| FD | 6–7% | Flexible | Taxable | General |

Conclusion: SSY offers best returns and benefits for girl children.

📲 Online Access

You can check your account balance via:

- Bank Net Banking

- Bank Mobile Apps

- India Post eBanking

- SMS alerts (if enabled)

Application Form Overview

The form includes:

- Name of the girl child

- Guardian’s information

- ID & address proof details

- Deposit amount

- Nominee details

- Signature/thumb impression

Education & Empowerment

SSY provides funds for:

- Tuition fees

- Hostel accommodation

- College admission

- Vocational training

- Marriage expenses

This supports empowerment of girls across India.

Real-Life Example

Case 1:

- Account opened at age 2

- ₹1 lakh/year invested

- After 21 years → over ₹50 lakh corpus

- Used for engineering and MBA education

Case 2:

- Account inactive for 2 years

- Paid penalty of ₹100 (₹50/year)

- Reactivated and resumed deposits

Common Mistakes to Avoid

- Missing annual deposits

- Providing incorrect documentation

- Not updating contact/address details

- Believing it’s a short-term plan

- Trying to invest for NRIs (ineligible)

Frequently Asked Questions (FAQs)

Q. Can I open SSY online?

➡️ Some banks allow starting the process online, but physical documents are required.

Q. What if I don’t deposit one year?

➡️ You need to pay ₹50 penalty and the minimum ₹250 to reactivate.

Q. Can NRIs open SSY?

➡️ No. Only resident Indian girls are eligible.

Q. What happens on maturity?

➡️ Full balance including interest is paid to the girl child.

Advantages of Sukanya Samriddhi Yojana

- Government guaranteed returns

- Best interest rate among saving schemes

- Complete tax exemption (EEE)

- Flexible deposits

- Long-term financial planning

- Encourages savings for girl child’s future

- Easy to open and maintain

Who Should Invest in SSY?

- Parents with a daughter under 10

- Families planning for higher education or marriage

- Tax-saving investors

- Those seeking risk-free returns

How to Apply for SSY

- Visit the nearest Post Office or authorized bank

- Collect & fill out the SSY Form

- Attach required documents

- Submit initial deposit (₹250 to ₹1.5 lakh)

- Get SSY Passbook after account creation

Final Words

Sukanya Samriddhi Yojana is more than just a savings scheme — it’s a tool to empower girls, support education, and ensure financial independence. In 2025, with its high interest, tax-free growth, and government security, it remains a top investment choice for your daughter’s future.